By Hadiza Suleman

The federal government has suspended import duties and taxes on essential food items to make basic necessities more affordable for Nigerians. The measure is also to address the prevalent issue of hunger in the nation.

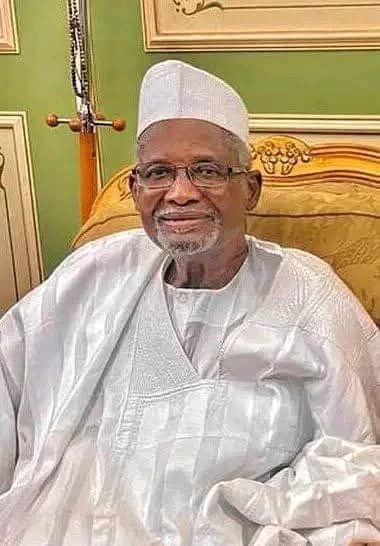

The Comptroller-General of the Nigeria Customs Service (NCS), Bashir Adeniyi, announced this Monday evening. He acknowledged the widespread economic challenges and outlined the government’s commitment to easing the financial burden on its citizens.

According to him, global inflation is impacting nations worldwide, including Nigeria, adding that to address this, the federal government, through the Nigeria Customs Service, is suspending import duties and taxes on essential food items to make them more affordable.

Adeniyi said the NCS had streamlined export processes to facilitate the efficient movement of Nigerian goods to international markets.

He said this initiative includes the introduction of advanced ruling systems, authorised economic operators, and a time-release study designed to enhance trade, stimulate the economy, and create new opportunities.

The Customs boss said these reforms would provide farmers, artisans, and entrepreneurs with a faster path to global markets, thereby benefiting their families and communities.

Quoting him, “We are committed to implementing this measure seamlessly to address the problem of hunger in our nation.”

He said in addition to economic measures, the NCS is intensifying its efforts to combat the proliferation of arms and dangerous weapons through Nigeria’s land, sea, and airports.

Adeniyi emphasized the importance of collective efforts and peaceful progress to strengthen the country’s borders, and warned that the destruction of the supply chain affects foreign investment, distorts trade, promotes instability, increases scarcity, and hinders revenue collection