By Jonathan Okpanachi

The Nigerian National Petroleum Corporation Limited’s stake in Dangote Refinery has nosedived to 7.2 per cent from the initial 20 per cent, according to Aliko Dangote, chief executive officer the refinery.

Dangote stated this in on Sunday during a parley with some media executives on a facility tour of the refinery.

He said the NNPCL only owns 7.2 per cent stake in the refinery due to its failure to pay the balance of its share, which was due in June this year.

Quoting him, “NNPC no longer owns a 20% stake in the Dangote refinery. They were meant to pay their balance in June but have yet to fulfil their obligations. Now, they only own a 7.2 per cent stake in the refinery.”

Our reporter gathered that until Dangote’s disclosure on Sunday, opinions were that the NNPCL had a 20 per cent stake in Dangote’s refinery, which has the capacity to produce 650,000 barrels per day of crude.

NNPCL had earlier claimed that it had acquired a 20 per cent stake in the Dangote Refinery for $2.76 billion.

Then in January 2024, NNPCL further said it had initially financed the 20 per cent stake through a $1.036 billion funding from Lekki Refinery Funding Limited, of which $1 billion was paid to Dangote Refinery and $36 million was for transaction costs.

The remaining $1.76 billion, the corporation said, was to be paid through a combination of a $2.5/barrel discount on 300,000 barrels per day of crude oil supplied to the refinery, and 100 per cent of NNPCL’s portion of any dividends declared by the refinery.

It revealed the details of these transactions in its audited financial statements for 2022, saying the investment was held by NNPCL Greenfield.

According to the oil firm, NNPCL Greenfield is a special purpose vehicle which is 100 percent owned by NNPCL

“This acquisition was financed by a $1.036 billion funding from Lekki Refinery Funding Limited of which $1 billion was paid to Dangote Refinery and $36 million accounting for transaction costs,” the statement said.

To raise the $1.036 billion from Lekki Refinery Funding Limited, the corporation said, “The balance of the cost of equity investments made in DPRP FZE, which is USD1.76 billion will be paid upon completion of the refinery project starting April 1, 2023 or any other date agreed between the parties (NNPCL and Dangote Oil Refining Company Limited) via a combination of a $2.5/bbl discount (on the official selling price) per barrel on 300,000 barrels per day to DPRP FZE, and 100% of NNPC’s portion of any dividend declared by DPRP FZE throughout the repayment period.”

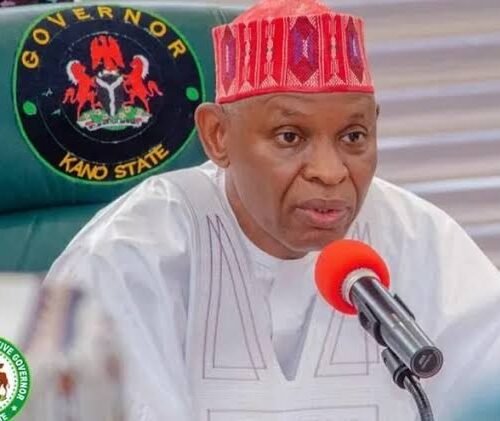

Reacting to Dangote’s statement, the NNPC in a press release on Sunday evening, said the company “made a commercial decision to cap our investment at the amount already paid.”

The spokesperson of the corporation, Olufemi Soneye, said, “Several months ago, we made a commercial decision to cap our investment at the amount already paid. This decision was taken by NNPC Ltd and has no impact on our business.

“NNPC Limited periodically assesses its investment portfolio to ensure alignment with the company’s strategic goals.

“The decision to cap its equity participation at the paid-up sum was made and communicated to Dangote Refinery several months ago.”