*Urges Advocacy Of Higher Tax

By Sylvia Kodilichukwu, Enugu

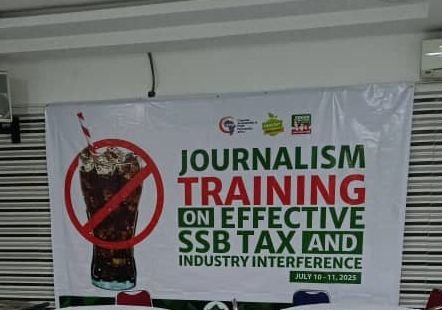

Corporate Accountability and Public Participation Africa (CAPPA) has trained journalists from the South-East zone on the need for Federal Government (FG) to raise sugar-sweetened beverage tax, urging them to inform and educate the public on the devastating health impact of sugary drinks on Nigerians’ economic future.

Executive Director of CAPPA, Akinbode Oluwafemi, in a welcome address, disclosed that the training, which took place at the Exclusive Serene Hotel and Suites, Enugu, with theme ‘Sugar-Sweetened Beverages (SSB) Tax and Industry Interference’, was vital for public health.

Oluwafemi lamented that Nigerians are facing an alarming rise in non-communicable diseases (NCDs) such as Type-2 diabetes, heart disease, and obesity, which were once considered rare, and cut across income levels and age groups.

He said: “Our hospitals are overflowing with patients, our families are burdened with healthcare costs, and our productivity is shrinking. Non-communicable diseases currently account for about 30 per cent of all deaths annually in Nigeria, and over 75 per cent of all deaths worldwide, according to the World Health Organisation (WHO).”

Oluwafemi emphasized that the cause of the crisis is a flood of ultra-processed ‘food’ products (UFPs), especially sugar-laden drinks, that masquerade as refreshment, but deliver nothing except harm.

The CAPPA boss, however, advocated for increase in SSB tax but stressed that there is an aggressive sugary drinks industry that manufactures and profits from these unhealthy diets, deploying misinformation campaigns and lobbying to delay or block life-saving policies and interventions such as the SSB tax.

“The SSB tax is a public health policy that imposes a levy on sugary drinks to discourage excessive consumption, reduce sugar-related diseases, and generate revenue for health promotion. In Nigeria, this tax was introduced in 2021 at ₦10 per litre of any sugar-sweetened, non-alcoholic beverage, and carbonated drinks.

“From the outset, Nigeria’s current ₦10 per litre SSB tax, while well-intentioned, is and has always been ineffective. For a tax meant to increase retail prices and reduce consumption of sugary drinks, ₦10 per litre was simply too small to make an impact. At the time, one litre was roughly equal to three bottles of the standard 33cl soft drink.

“Back then, each bottle sold for about ₦150. So, ₦10 per litre translated to just about ₦3 extra per bottle — barely noticeable to consumers and certainly not enough to change buying habits.

“Today, that same 33cl bottle often sells for ₦300 or more, yet the tax is still stuck at ₦10 per litre — still just ₦3 per bottle.

“This token amount does not push consumers to reconsider their choices, nor does it pressure companies to reformulate the sugar content in their products. In fact, it is a drop in the ocean compared to the tidal wave of health impacts sugary drinks are causing in our society.

“Research has shown that an increase of the SSB tax to at least ₦130 per litre is the effective threshold on sugary drinks for Nigeria. This shows that taxing sugary drinks at meaningful levels will save lives, deliver real public health gains and bring Nigeria in line with global recommendations.

“The World Health Organisation (WHO) has repeatedly advised that an SSB tax that causes at least a 20 per cent increase in the retail prices of sugary drinks leads to a proportional reduction in consumption.

“Just a few days ago, the WHO even went further, urging Nigeria and other member countries to raise the prices of sugary drinks, alcohol and tobacco by 50 per cent through taxation over the next 10 years, to help curb rising non-communicable diseases,” he rallied.

The organization expressed confidence that health taxes are one of the most efficient tools to cut the consumption of harmful products and create revenue that governments can reinvest in health care, education, and social protection.

Oluwafemi charged journalists to remember that public health is a human right, not a privilege to be negotiated with corporate interests, arguing that Nigerians deserve policies that protect their health, not appease multinationals.

He further urged them to either use their voices and amplify the truth or echo industry propaganda.

“You have the power to Inform the public about the devastating health impacts of sugary drink overconsumption. Hold policymakers accountable for delaying or watering down life-saving interventions. Investigate the covert tactics of industry misinformation, scaremongering and lobbying. Shine a light on the communities most affected by diet-related diseases.

“Hence, this training is not just about reporting taxes. It is about equipping you with the tools to tell the story of a growing public health crisis and the policy solutions that could transform lives.

“The public needs stories that centre on the lived experiences of ordinary Nigerians whose health is being sacrificed on the altar of sugary profits.

“In conclusion, the health of over 200 million Nigerians must take precedence over the bottom line of a handful of beverage companies. Raising the SSB tax to ₦130 per litre is not just a fiscal measure—it is a moral imperative. It is a matter of life and death. And it is one of the most effective tools we must utilise to stop a growing epidemic before it overwhelms our nation.

“So, as you embark on this two-day training, I urge you to carry this message forward with courage, integrity, and clarity. Nigeria’s health future is at stake. And your pen—or platform—may just be the scalpel that helps save it,” he contended.